Digest of Key Crypto World Events for October 6-12, 2025

Market and Cryptocurrency Dynamics The week was generally marked by turbulent dynamics in leading cryptocurrencies. Bitcoin set a new all-time high above $126,000 early in the week, consolidating around $121,000–124,000 levels. The price remained volatile with profit-taking and local corrections. Ethereum hovered near achievable highs around $4,700, though also demonstrating significant fluctuations. Among top-10 assets, BNB stood out with weekly gains up to 24%, along with substantial Dogecoin growth in recent days (+11%). Meanwhile, XRP, Cardano, and Solana showed some declines by period's end.

Total cryptocurrency market capitalization rose above $4.3–4.5 trillion during peak days, with increasing institutional activity, particularly in Bitcoin-based products (ETFs and options).

Institutional Activity and Regulation Morgan Stanley for the first time recommended clients allocate 2% to 4% of portfolios to Bitcoin, potentially attracting up to $80 billion inflows. Analysts view Bitcoin as a scarce asset, a digital gold analogue, strengthening its status among major investors.

Russia is discussing legislation to include digital financial assets (DFA) in mutual investment funds, implying recognition of digital currencies alongside traditional securities with corresponding regulation and investor protection.

The U.S. Securities and Exchange Commission (SEC) under Paul Atkins' leadership plans to introduce "innovation exemptions" by late 2025-early 2026, temporarily simplifying certain regulations for Web3 companies and stimulating new product and project development.

Technological and Business News MetaMask launched new MetaMask Perps platform for trading perpetual futures contracts on mobile devices with up to 40x leverage across 150+ EVM network tokens.

Russian retailer "Zolotoe Yabloko" issued its own digital financial assets yielding 17.5% annually on Alfa-Bank's "A-Token" platform, representing crypto asset integration into traditional business.

ARK Venture fund invested $10 million in asset tokenization company Securitize, reflecting growing interest in innovative financial technologies.

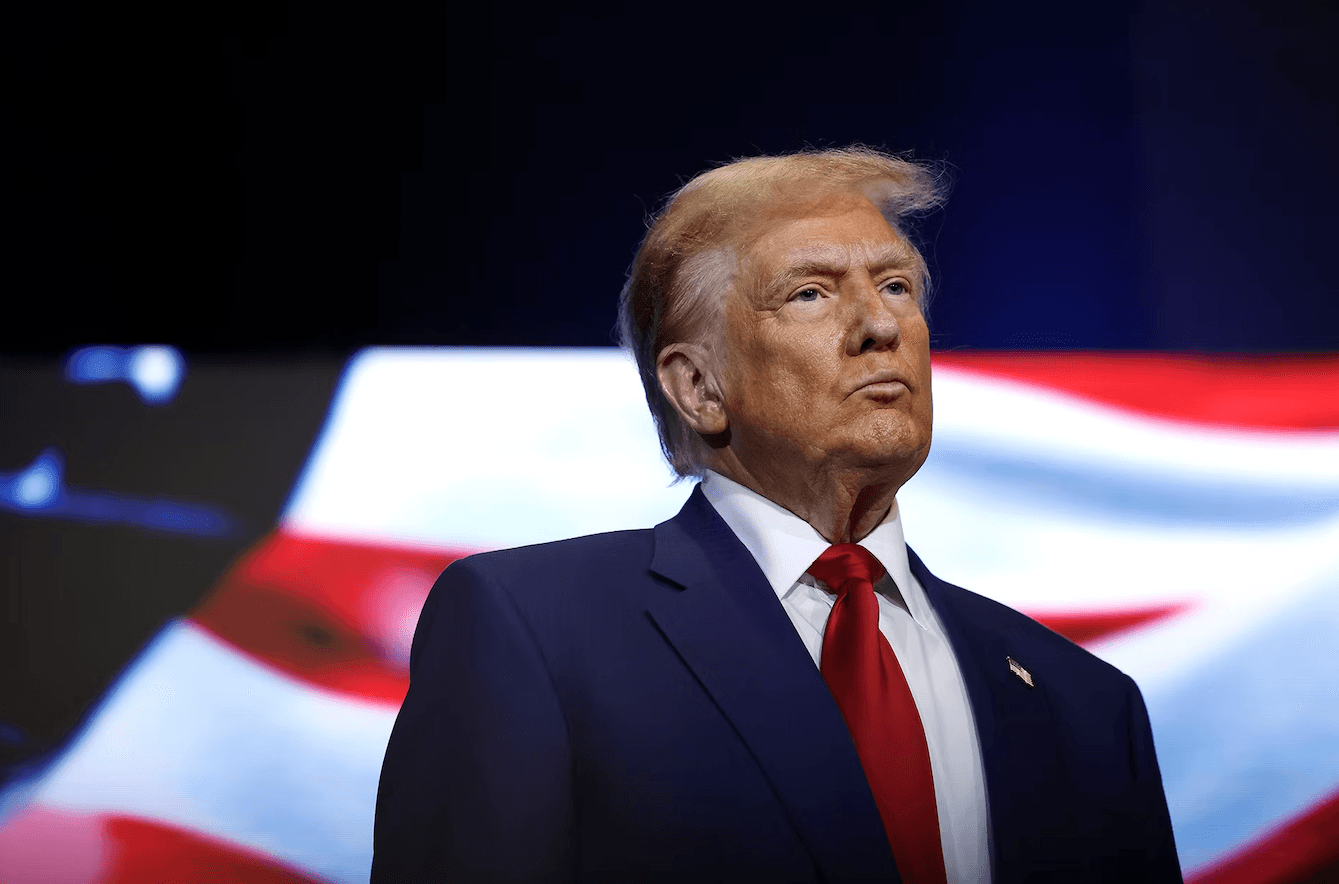

Crisis and Sharp Movements On October 11, the market experienced a sharp decline: Bitcoin lost over $10,000 within 1.5 hours, Ethereum collapsed 15-30%. The primary cause was political risks - U.S. President Donald Trump's announcement of 130% tariffs on Chinese goods severely impacted market sentiment, including cryptocurrencies. This triggered liquidation cascades and significant losses in the altcoin segment.

Prospects and Conclusions In short- and medium-term perspectives, Bitcoin continues to be perceived as a key digital asset with growing institutional interest and regulatory support. Strengthening regulatory frameworks and technological innovations, such as derivative trading platforms, are expanding investor opportunities.

Nevertheless, geopolitical events and macroeconomic risks remain significant factors capable of causing sharp market fluctuations. Investors should account for volatility and diversify portfolios, balancing long-term potential against short-term market shocks.